Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

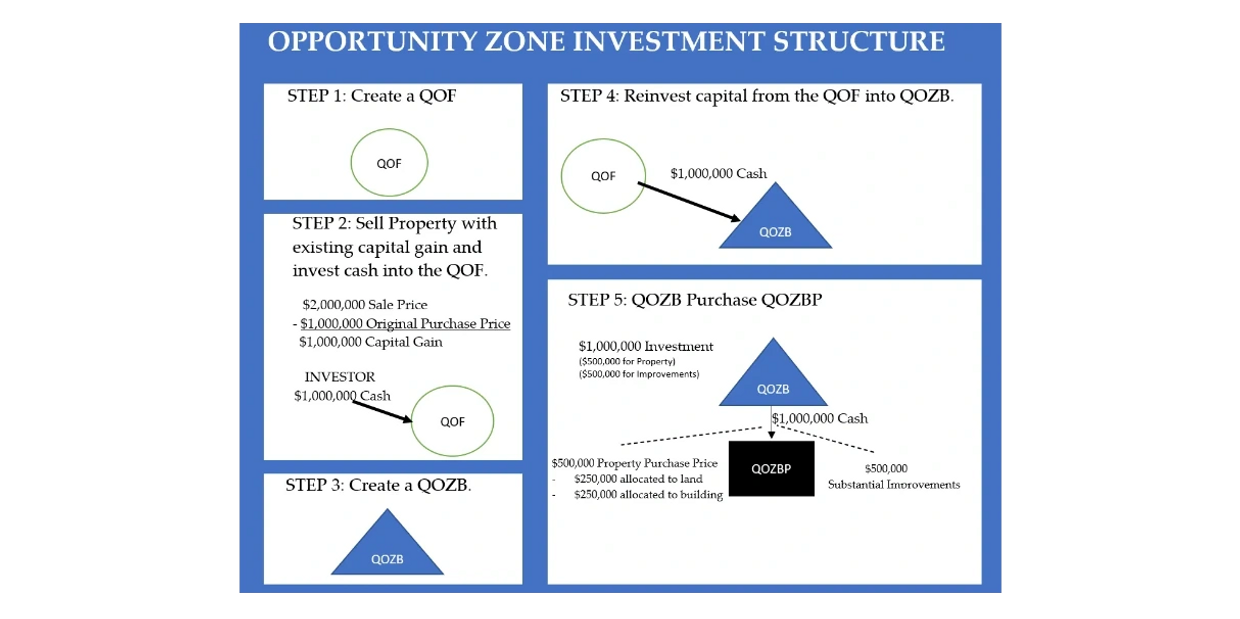

Opportunity zone investments are as complex as they are lucrative, and require a specific investment structure. To structure a Qualified Opportunity Zone (QOZ) investment that qualifies for the tax incentives, opportunity zone investors are required to set up an investment vehicle called a Qualified Opportunity Fund (QOF) into which they will invest their capital gains with 180 days.

To be considered a Qualified Opportunity Fund there are five requirements:

Opportunity zone investors must contribute cash or other property to the Qualified Opportunity Fund (QOF) in exchange for an eligible interest (equity interest) in the QOF. While opportunity zone investors are free to invest an unlimited amount of capital into a Qualified Opportunity Fund, only the portion equaling their capital gains will qualify for tax-free growth. The portion of an investor's eligible interest qualifying for tax incentives is known as a qualifying interest. Additionally, to qualify for the opportunity zone tax incentives, contributions to the Qualified Opportunity Fund must be made within 180 days following the date capital gain would be recognized for federal income tax purposes (the sale date or distribution date).

After making a capital contribution to the Qualified Opportunity Fund, opportunity zone investors are required to make a deferral election. Opportunity zone investors make a valid deferral election by completing a Form 8997. A deferral election discloses to the IRS the opportunity zone investment and covers only qualifying interests in a QOF. By making a deferral election, an eligible interest in the QOF becomes a qualifying interest to which the opportunity zone tax benefits apply. Additionally, opportunity zone investors are required to file a Form 8949 in the taxable year capital gains would be initially included if not deferred.

Upon contributing capital to the Qualified Opportunity Fund (QOF), the QOF will need to create a Qualified Opportunity Zone Business (QOZB). The QOF is required to begin testing compliance with the 90% Investment Standard at the end of its first tax year. The 90% Investment Standard requires that at least 90% of a QOF’s assets be Qualified Opportunity Zone Property (QOZP). Compliance with the 90% Investment Standard is tested semi-annually throughout opportunity zone investment. Failure to comply results in harsh penalties.

Qualified Opportunity Zone Property (QOZP) Includes: (i) QOZ Stock in a QOZB; (ii) QOZ Partnership Interests in a QOZB; and (iii) Qualified Opportunity Zone Business Property (QOZBP).

Qualified Opportunity Zone Business (QOZB) Requirements:

5 Tests (QOZB) that must be met to satisfy all requirements in § 1400Z2(d)(3)(A):

Opportunity Zone Business Property (QOZBP): SEE STEP 5

After creating an Opportunity Zone Business (QOZB), the Qualified Opportunity Fund (QOF) will acquire Qualified Opportunity Zone Property (QOZP). The Qualified Opportunity Fund will transfer cash contributed by investors with any debt proceeds into the Qualified Opportunity Zone Business (QOZB) in exchange for QOZ stock or QOZ partnership interests.

QOZ stock: includes stock in a domestic entity classified as a corporation for federal tax purposes if all of the following requirements are met: (i) The QOF acquired the stock after December 31, 2017, at its original issue (directly or through an underwriter) from the corporation solely in exchange for cash; (ii) At the time the corporation issues the stock, the corporation is a QOZB (see § 1400Z-2(d)(3) and Reg. § 1.1400Z2(d)-1(d)) or, if the corporation is a new corporation, it was being organized for purposes of being a QOZB; and (iii) During substantially all (90%) of the QOF’s holding period for the stock, determined on a cumulative basis pursuant to Reg. § 1400Z2(d)-1(c)(2)(i)(C)(2), the corporation qualified as a QOZB.

QOZ partnership interest is a capital or profits interest in a domestic entity classified as a partnership for federal tax purposes if all of the following requirements are met: (i) The QOF acquired the partnership interest from the partnership solely in exchange for cash; (ii) At the time the QOF acquired the interest, the partnership is a QOZB or, if the partnership is a new partnership, it was being organized for purposes of being a QOZB; and (iii) During substantially all (90%) of the QOF’s holding period for interest, determined on a cumulative basis, the partnership qualified as a QOZB.

An Opportunity Zone Business (QOZB) must satisfy 5 Tests for the Qualified Opportunity Fund (QOF) investment into the QOZB to qualify as QOZP when testing compliance with the 90% Investment Standard. Compliance with the 5 test tests is determined each year at the end of the QOZB’s taxable year. However, a QOZB with a valid working capital safe harbor allows a QOZB to be in automatic compliance with QOZB Tests 1-4 for up to 31 months or up to 62 months with sequential overlapping working capital safe harbors. Still, remember that one of the 5 Tests for QOZB compliance requires that 70% of all of the tangible property owned or leased by the QOZB must be Qualified Opportunity Zone Business Property (QOZBP). While testing compliance with this requirement is suspended when a valid working capital safe harbor is in effect, QOZBs will ultimately have to satisfy this 70% tangible property standard each year for the remainder of the opportunity zone investment.

QOZBP: is tangible property used in a trade or business; that meets the following requirements:

Substantial improvement: if during any 30-month period beginning after the date of acquisition, additions to basis of property exceed an amount equal to the portion of purchase price allocated to existing buildings at the beginning of the 30-month period.

DISCLOSURE: Pursuant to IRS Circular 201, this website does not constitute tax advice and you may not rely upon the information contained herein. The tax code is complex and nuanced rules exist which are summarized on this website. Tax advice may only be relied upon when obtained pursuant to an attorney- client relationship with our firm.

Copyright © 2022 OZ INVESTED - All Rights Reserved.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.